Liquidity Management Tools (LMTs) for Sawakami Mixed Fund

What are Liquidity Management Tools (LMTs)?

Liquidity Management Tools (LMTs) refer to the tools utilized for managing fund liquidity during abnormal situations. The purpose is to protect and safeguard the interests of all unitholders and minimize the potential impact on fund net asset value (NAV) resulting from liquidity shortages. Moreover, LMTs also serve to mitigate the potential adverse effects on a broad spectrum of financial systems.

Sawakami Asset Management (Thailand), as an Asset Management Company (AMC), has identified the following Liquidity Management tools for implementation within the fund

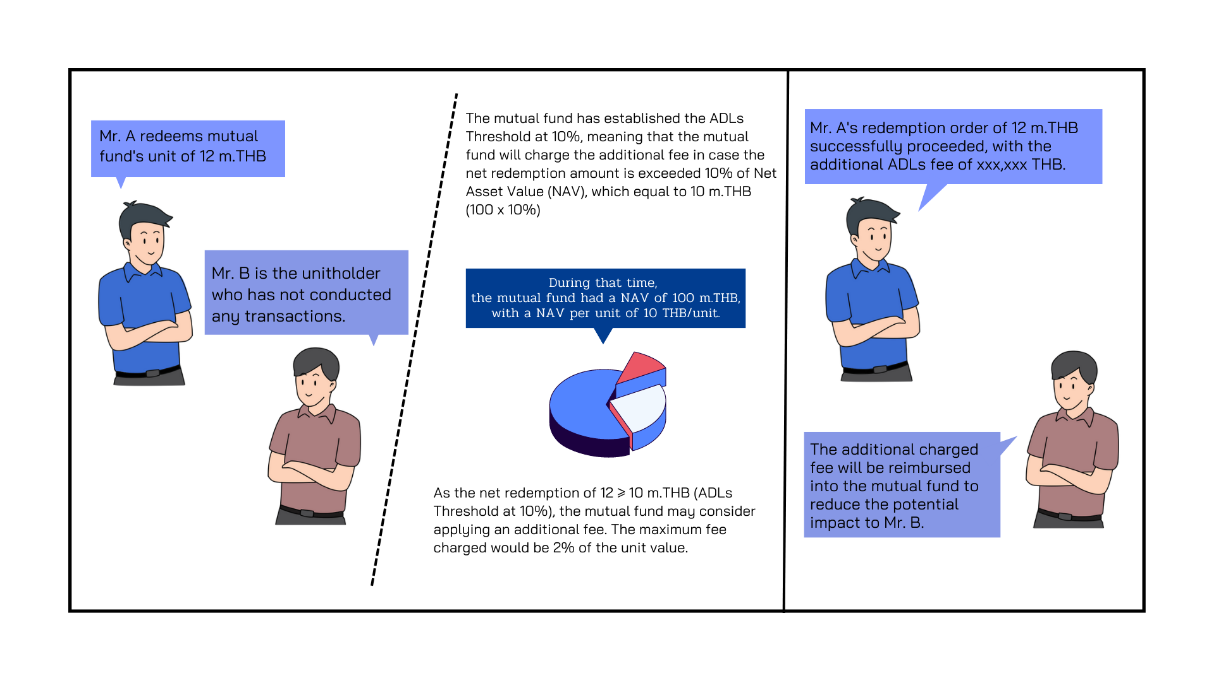

1.) Anti-Dilution Levies-ADLs

Example implementation of Anti-Dilution Levies-ADLs

The Asset Management Company (AMC) will consider using Anti-Dilution Levies-ADLs when the net redemption on that day reaches or exceeds 10% of NAV. This additional fee will be charged to all unitholders who redeem on that day, with a maximum ADLs fee at 2%. This fee charged will be returned to the mutual fund to reflect the costs or expenses incurred from trading the mutual fund's assets.

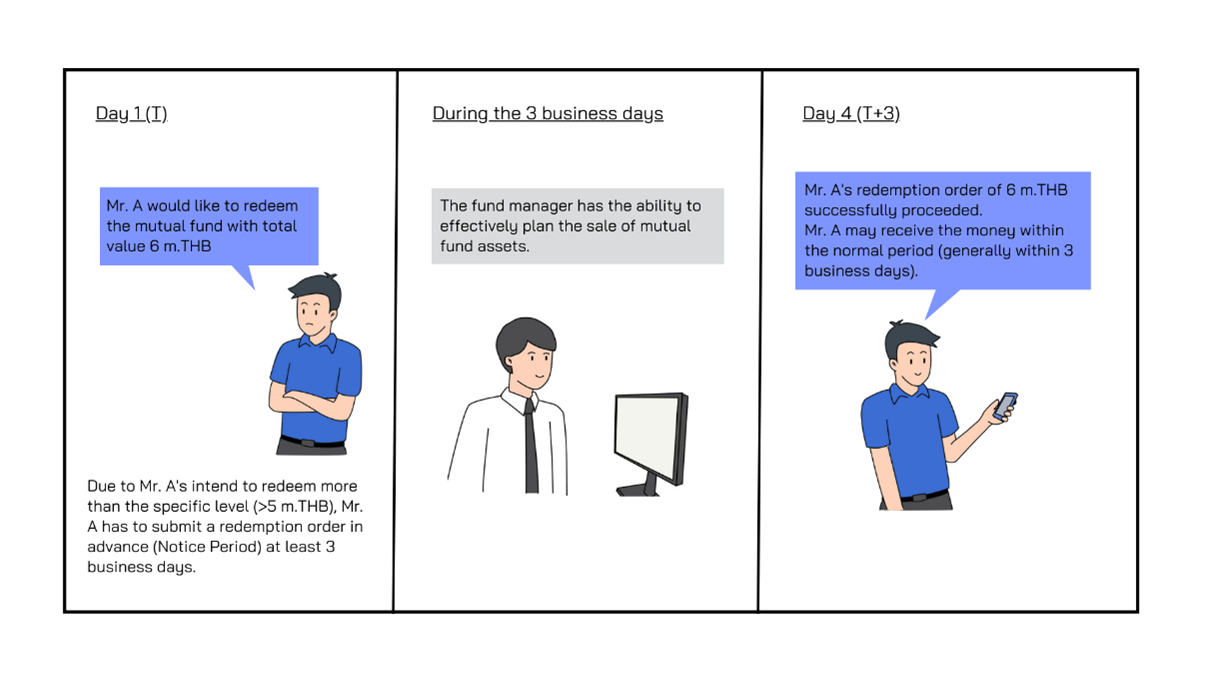

2.) Notice Period

Example implementation of Notice Period

The Asset Management Company (AMC) has established a policy stating that any unitholder intending to redeem fund units exceeding 5 million baht must submit the redemption order at least 3 business days in advance. This advance notice allows AMC to plan to sell the fund’s assets for repay to redemption order at a reasonable price. However, if the scheduled transaction date for the notice period order coincides with the need to utilize other LMTs, the AMC will also use the other LMTs in conjunction with the previously received notice period order.

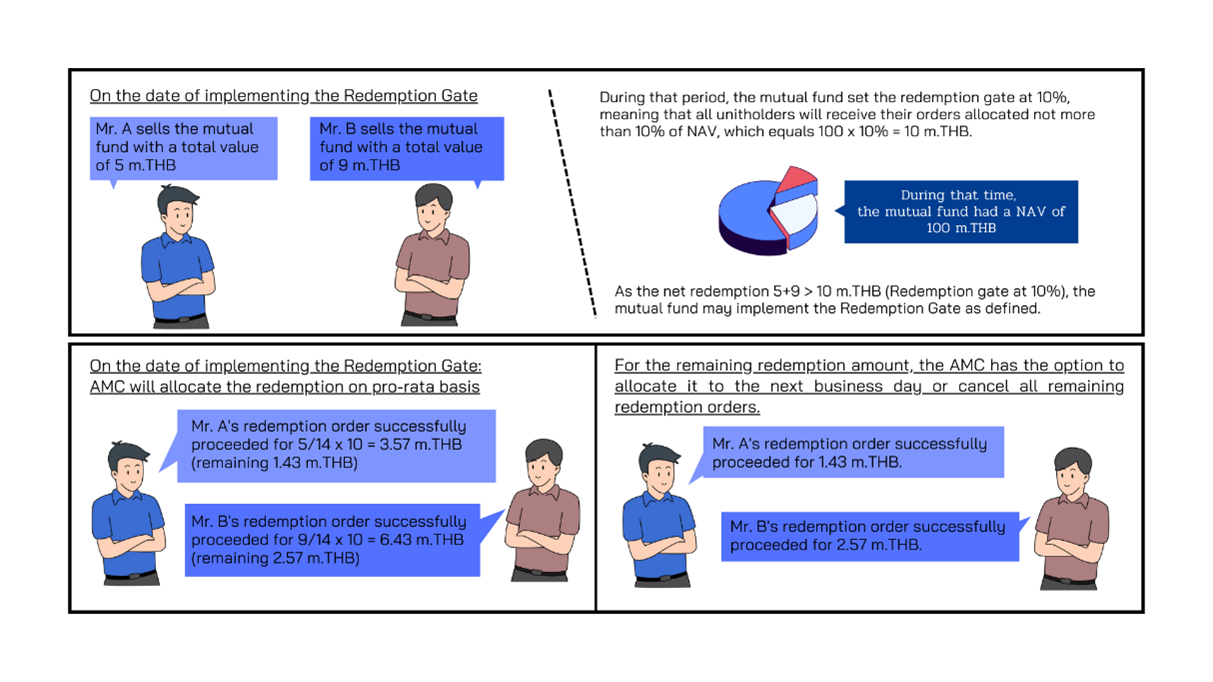

3.) Redemption gate

Example implementation of Redemption gate

The Asset Management Company (AMC) may contemplate implementing the Redemption Gate when the net redemption exceeds a specified threshold (minimum of 10% of NAV). When using this tool, the unitholders who submit redemption orders on that day will have their orders allocated on a pro-rata basis from the ceiling redemption amount. However, if the AMC deems that the mutual fund maintains sufficient liquidity to fulfill all redemption orders without the need for urgent to sell the fund’s assets at unreasonable prices, the AMC may decide not to implement the redemption gate on that day.

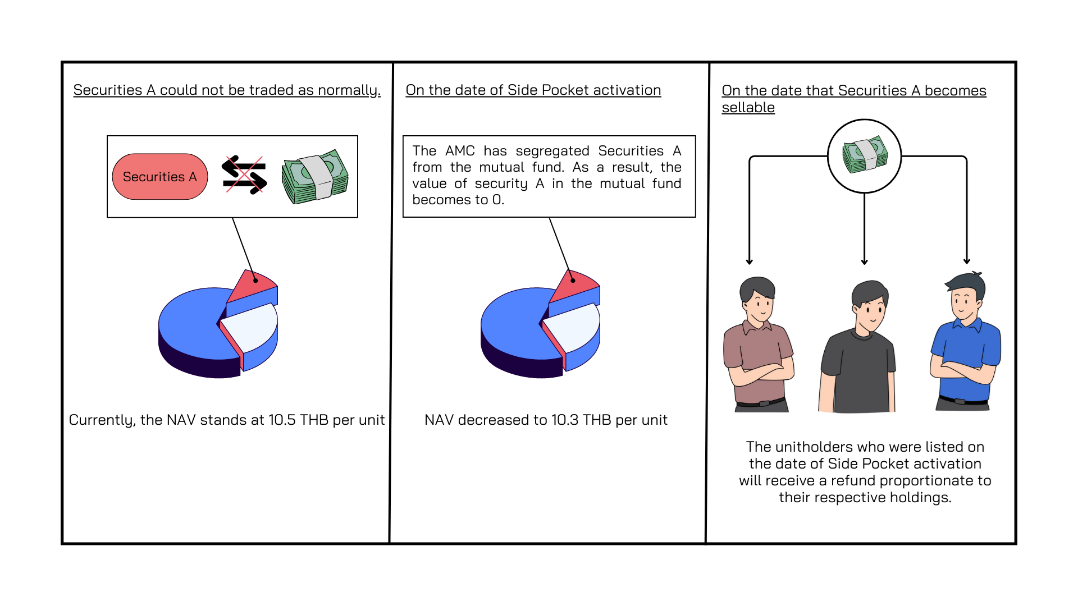

4.) Side Pocket

Example implementation of Side Pocket

The Asset Management Company (AMC) may utilize the Side Pocket when the mutual fund's significant assets encounter liquidity issues or cannot be sold at a reasonable price. Upon obtaining the approval from the Trustee, AMC will compile a list of unitholders and segregate the illiquidity asset into the Side Pocket including record the value of that asset in the mutual fund as 0. If subsequently, the company can sell that asset, the listed unitholders on the date of Side Pocket activation will be entitled to receive proceeds from the asset. However, AMC may repay that asset to unitholders in the form of the asset (Pay-in-kind) in case AMC considers that it would be more beneficial for the unitholders due to the illiquidity asset cannot be sold within a reasonable timeframe.

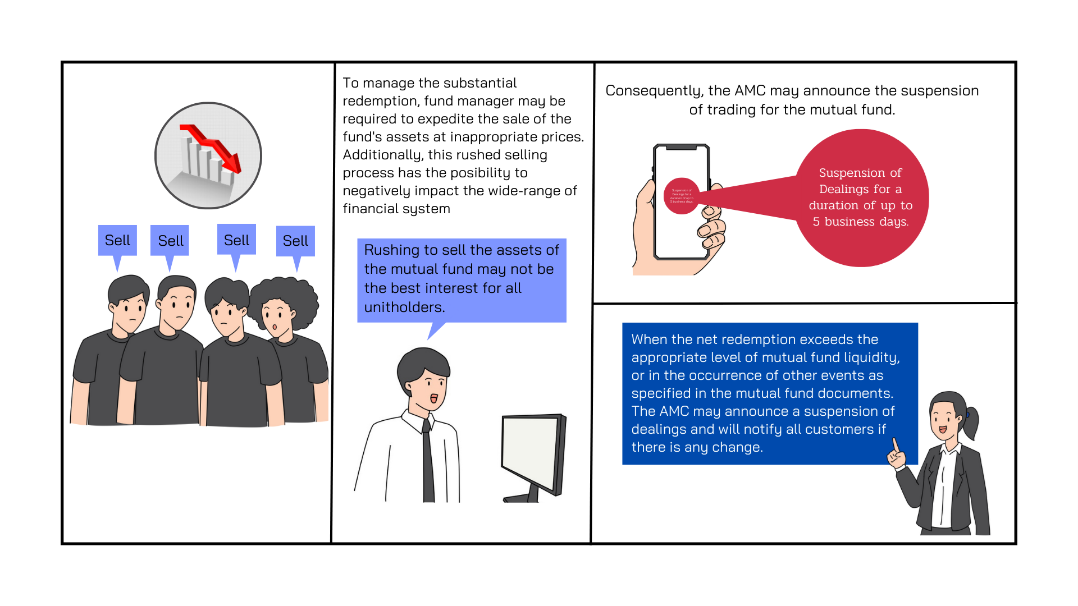

5.) Suspension of Dealings

Example of Suspension of Dealings

The Asset Management Company (AMC) may announce the implementation of Suspension of Dealings to protect the best interest of all unitholders. This may occur when either the net redemption or the cumulative net redemption over the past five business days reaches or exceeds 40% of the Net Asset Value (NAV), when the AMC is unable to calculate the fund's asset value fairly and appropriately, or when any other event specified in the mutual fund documents. Following approval from the Trustee, the mutual fund will be stopped to trade for a maximum of 5 business days unless approved by the SEC. However, the Suspension of Dealings will be conducted with consideration for the best interests and fairness of all unitholders, including both transactional and non-transactional unitholders. The objective is to minimize the risk of mutual fund illiquidity and potential harm to the wide range of the financial system.

In this regard, Sawakami Asset Management (Thailand) Co., Ltd will consider to employing the appropriate tools to manage liquidity risk in mutual funds, prioritizing the best interests of the mutual funds and unitholders.

All unitholders can review the liquidity management tools in the Sawakami Mixed Fund prospectus or study the details of all liquidity management tools of the mutual funds according to the regulations of the Securities and Exchange Commission, Thailand (SEC) at SmartToInvest รู้จัก Liquidity Management Tools (LMTs) เครื่องมือบริหารความเสี่ยงสภาพคล่องกองทุนรวม

Note :

This article has been prepared in both Thai and English languages, presenting identical content. In the event of any discrepancies or inconsistencies between the 2 versions, the Thai language version shall prevail as the authoritative and correct version.

Reference:

- แนวปฏิบัติการใช้เครื่องมือบริหารสภาพคล่องของสมาคมบริษัทจัดการลงทุน | Liquidity Risk Management Tools Guideline from Association of Investment Management Companies (AIMC)

- ประกาศคณะกรรมการกำกับตลาดทุนที่ ทน. 11/2564 เรื่อง หลักเกณฑ์การจัดการกองทุนรวมเพื่อผู้ลงทุนทั่วไป กองทุนรวมเพื่อผู้ลงทุนที่มิใช่รายย่อย กองทุนรวมเพื่อผู้ลงทุนประเภทสถาบัน และกองทุนส่วนบุคคล | Announcement of the Securities and Exchange Commission, Thailand (SEC), Tor Nor 11/2023: Rules for managing mutual funds for general investors, mutual funds for non-retail investors, mutual funds for institutional investors, and private fund

Made by Investment Risk Management Department

25 JUL 2023

SHARE :